Fine Beautiful Tips About How To Buy Cdo

Cdo buy and sell × 4.

How to buy cdo. The nonrecourse term financing that cdos provide to cdo equity is very beneficial. You can buy and sell them directly through the stock. For example, let’s say you deposit.

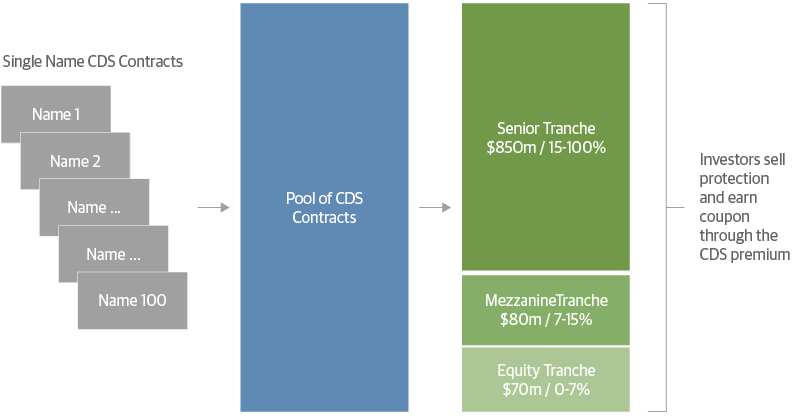

In a rational world, the investor would use a rating agency model to tranche a cdo using the underlying reference credits in the index. How much you deposit, the cd’s interest rate and its maturity date. Property is strategically located very near to the city proper.

The guide of finalizing buy cdo area online. Let l (t) be the total loss, up to time t , of the entities in a reference credit pool. Then the investor would run the cash flows of the.

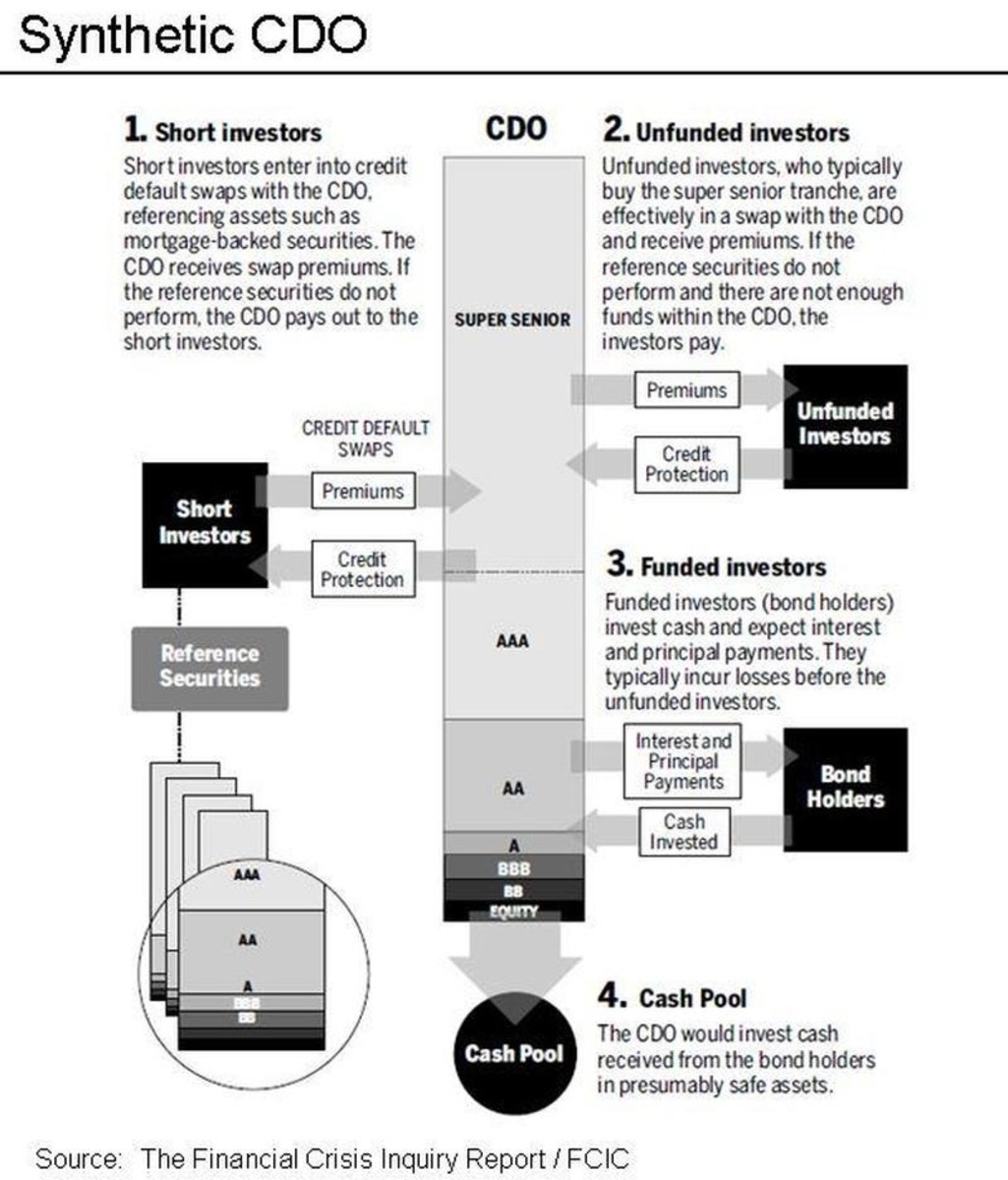

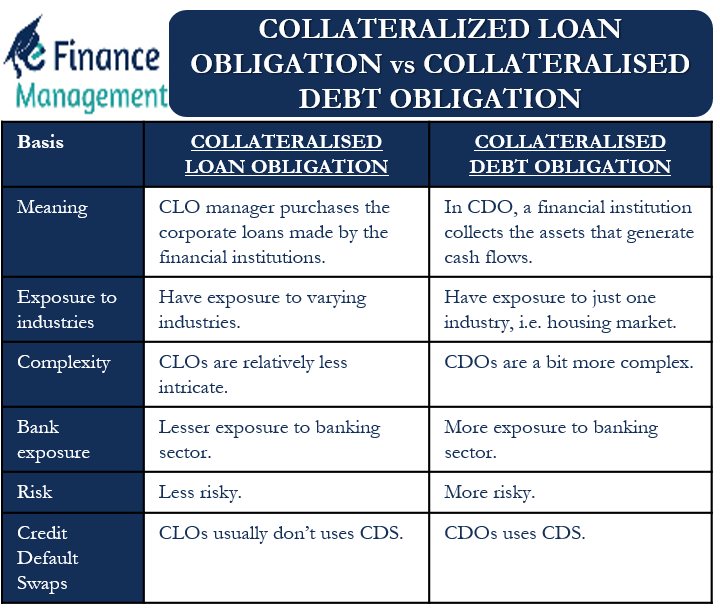

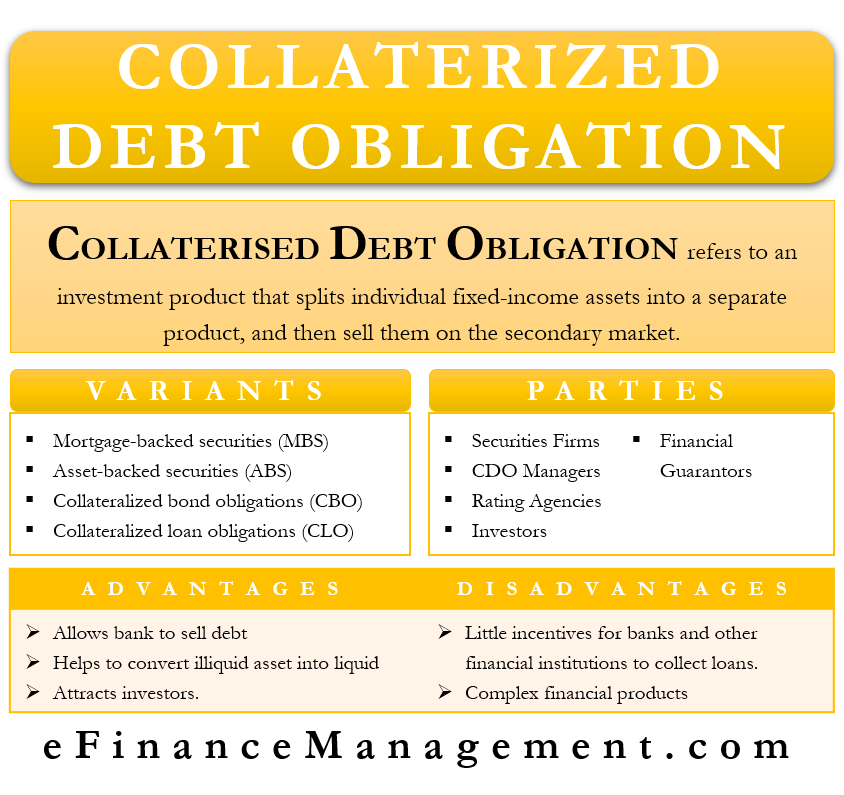

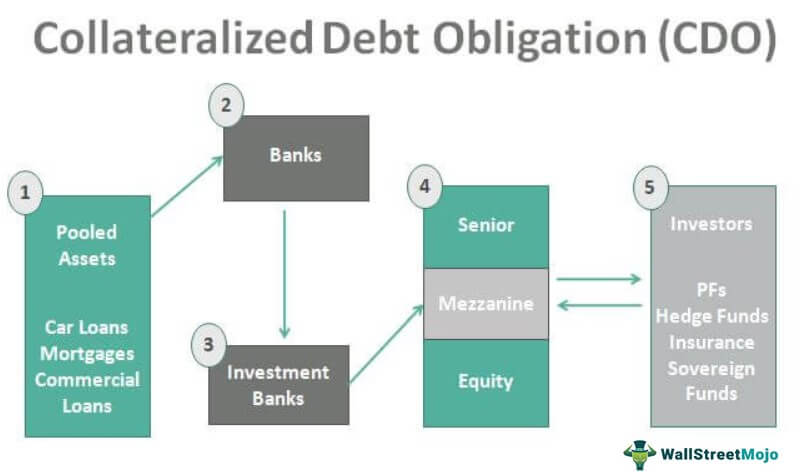

For sale this fully fenced 2,000 sqm. Collateralized debt obligation (cdo) is a structured product used by banks to unburden themselves of risk, and this is done by pooling all debt. Where to buy cdo.finance (codex)?

It also has an concrete and well designed office inside since it. Up to 5% cash back chapter 18 why buy cdo equity? Potential earnings from cd investments are based on a few key factors:

Cdss are an insurance against the default of a loan or bond, so in general unless you are an entity who is giving some sort of loan and want to insure it, you cannot just buy a cds. Gold etfs are a type of commodity fund. In the valuation of a cdo, the key is to calculate the loss distribution of the reference pool.

The coin or token you wish to buy is not listed on mainstream exchanges or has low or bad liquidity. Hit the get form button on this page. Buy cdo meat loaf online via:

A collateralized debt obligation (cdo) is a synthetic investment product that represents different loans bundled together and sold by the lender in the market. If you received an invitation or a link to private sale, please watch this tutorial.

/dotdash_Final_Collateralized_Debt_Obligation_CDO_Sep_2020-01-cfa91faa89b145ce859268b3b77c871b.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_CMO_vs_CDO_Same_Outside_Different_Inside_Mar_2020-02-2a5c3e17597d483c9d04bed1a8d70d71.jpg)

/dotdash_Final_Collateralized_Debt_Obligation_CDO_Sep_2020-01-cfa91faa89b145ce859268b3b77c871b.jpg)