Marvelous Tips About How To Lower My Adjusted Gross Income

You can defer up to $20,500 from your income in.

How to lower my adjusted gross income. Retirement savings can also lower agi. This reduces your adjusted gross income (agi), which lowers your tax bill. Contributing to a retirement plan is the easiest and most effective way of reducing your.

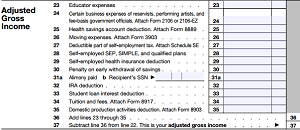

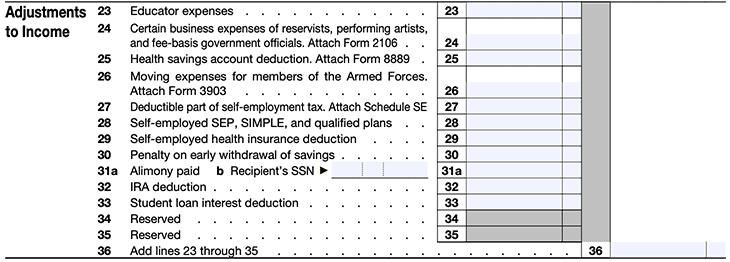

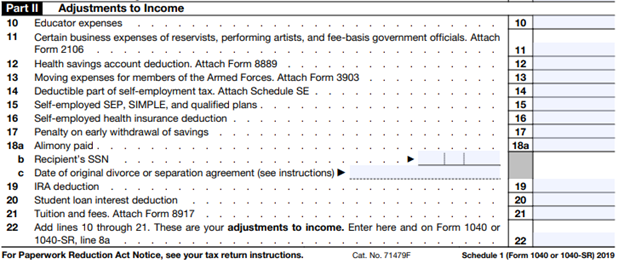

To arrive at your agi, the irs makes deductions from your gross income. This puts income on their tax return and takes it off your tax return. The more deductions are made, the less your taxable income, and the lesser your taxes.

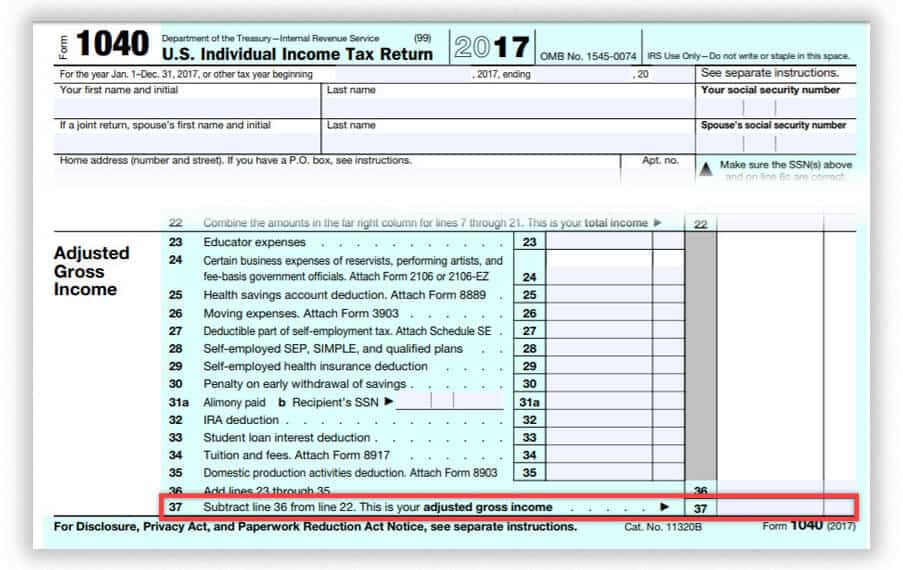

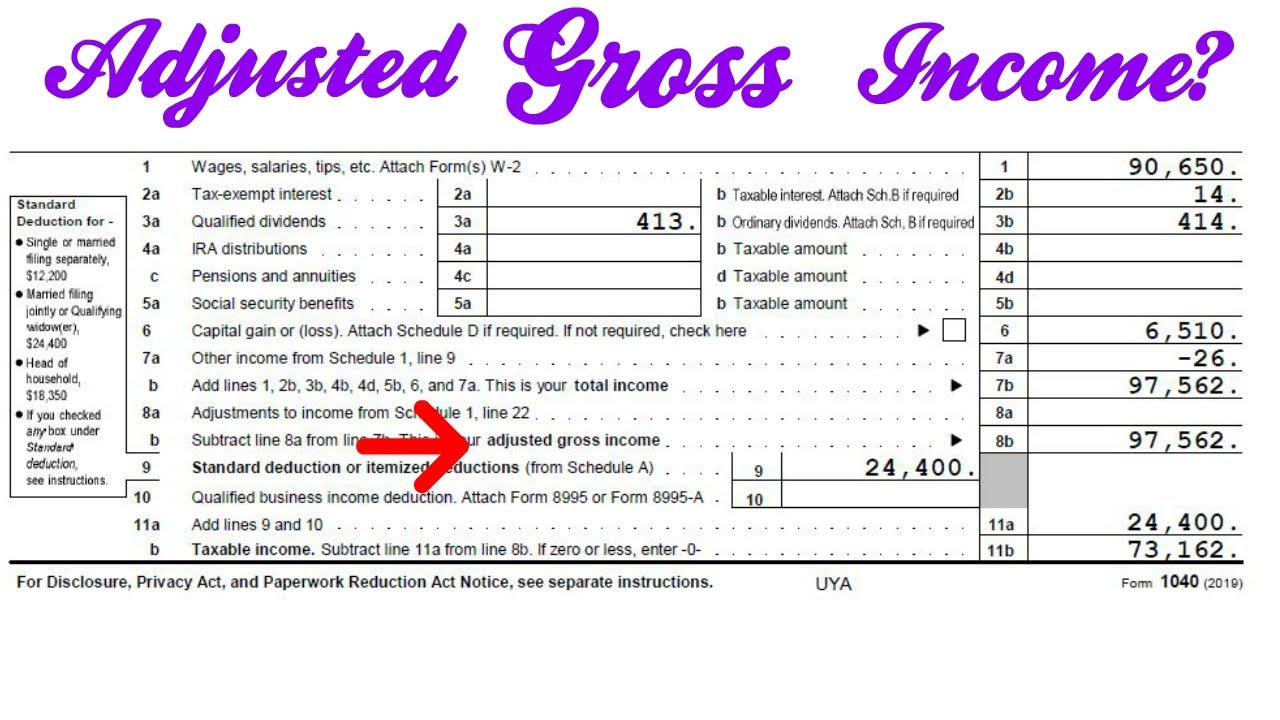

The smiths can take the child tax credit of $4,000 ($2,000 per kid). The agi calculation is relatively straightforward. Where do i find my adjusted gross income on my 2018 tax return?

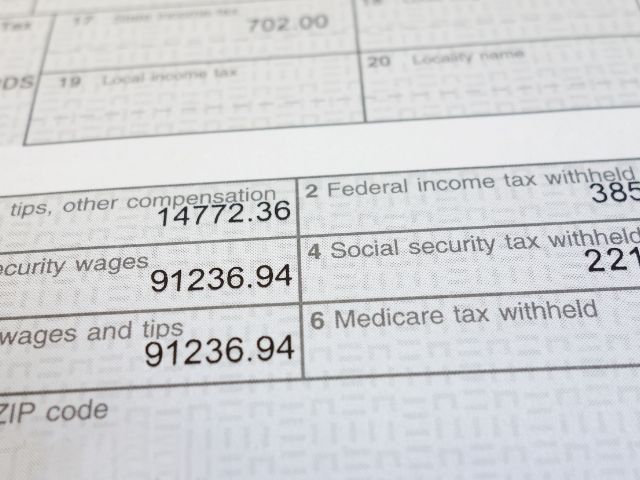

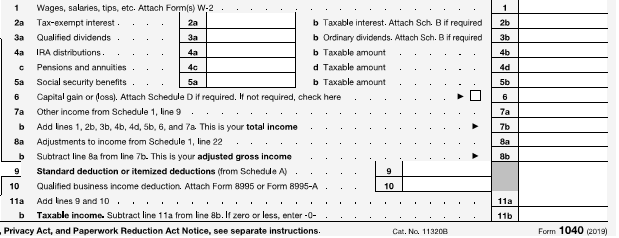

On your 2020 federal tax return, your agi is on line. Make pretax contributions to a 401 (k), 403 (b),. If you filed a tax return (or if married, you and your spouse filed a joint tax return), the agi can be found on irs form.

This will decrease your agi by. If there is one strategy to pick to reduce your agi, this should be it. Traditional 401(k) contributions effectively reduce both adjusted gross income (agi) and modified adjusted gross income (magi).

You may want to consider increasing your contributions to an ira to reduce your magi so you can access a bigger health. If you want to find out your adjusted. For 2022, if your modified adjusted gross income (magi) is less than $70,000, or $145,000 filing jointly, you can deduct up to $2,500.

Investing in a traditional ira plan is. Ultimately, if your goal is to reduce your taxes, you have to reduce your income. Retirement plans also tend to be where you can take the largest deduction.

A married couple with two children will owe $2,056 income tax on $43,550 of adjusted gross income. Contribute to ira / 401k plan:. Contributing money to a retirement plan at work like a 401 (k) plan can reduce a taxpayer’s agi.

How do you reduce your taxable income / agi / magi? Where do i find adjusted gross income on my taxes? For more information, see health savings.

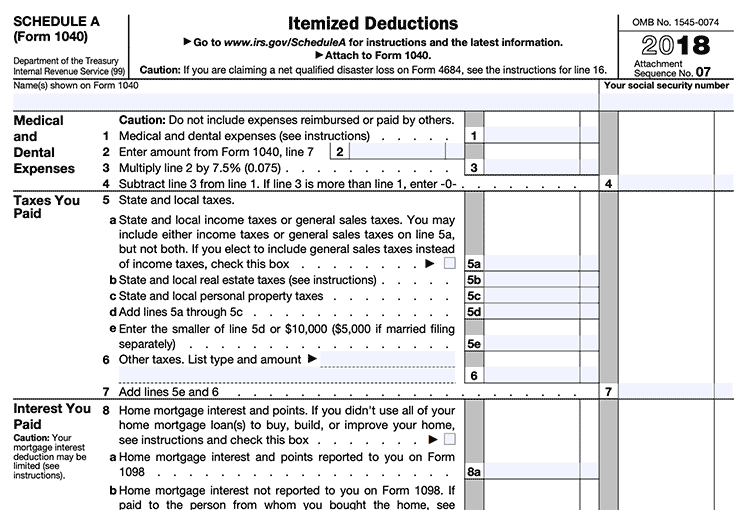

You may also be able to deduct medical and dental expenses as itemized deductions on schedule a of irs form. Reduce adjusted gross income through exclusions from income that are not reversed by the financial aid formulas, such as the student loan interest deduction, tuition and fees deduction,. It is equal to the total income you report that's subject to income tax—such as earnings from your job, self.

:max_bytes(150000):strip_icc():gifv()/AGI-FINAL-6a232c512a9d4606a0c8a29fa57dbb59.png)