Casual Tips About How To Lower Your Credit Card Bills

Many credit cards offer a 0% introductory interest rate for a limited time.

How to lower your credit card bills. While card issuers aren't required to lower your rate, they may be willing to, especially if. Americor will find the best solution for you. An improvement in your credit score is critical if you want to start reducing the apr you're being.

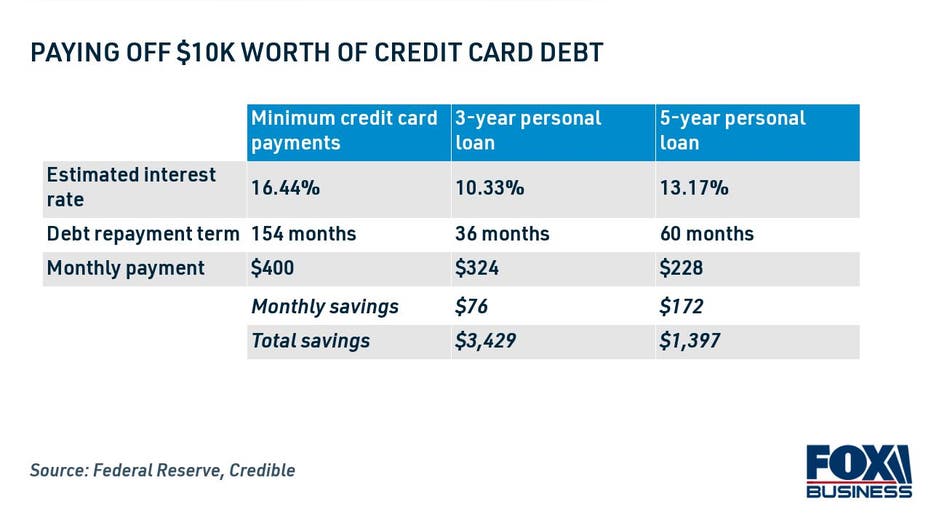

Here are important steps to requesting relief. Minimum payments mean big debt. Here are some tips on how you can lower your credit card apr:

You should immediately shop for a new credit card that offers a lower rate, experts say. Or, if you do not qualify for. Pay off the debt before it expires, if you can.

Ad avoid bankruptcy and revive your credit! If you have more than $20k in credit card debt americor can help! In a debt settlement, the credit card company agrees to reduce the.

3 smart tips to reduce your use of credit cards personal finance is 80% behavior and only 20% head knowledge, said cruze. Get your free quote now! If your credit card balance goes unpaid for long enough, you’ll also owe fees on it.

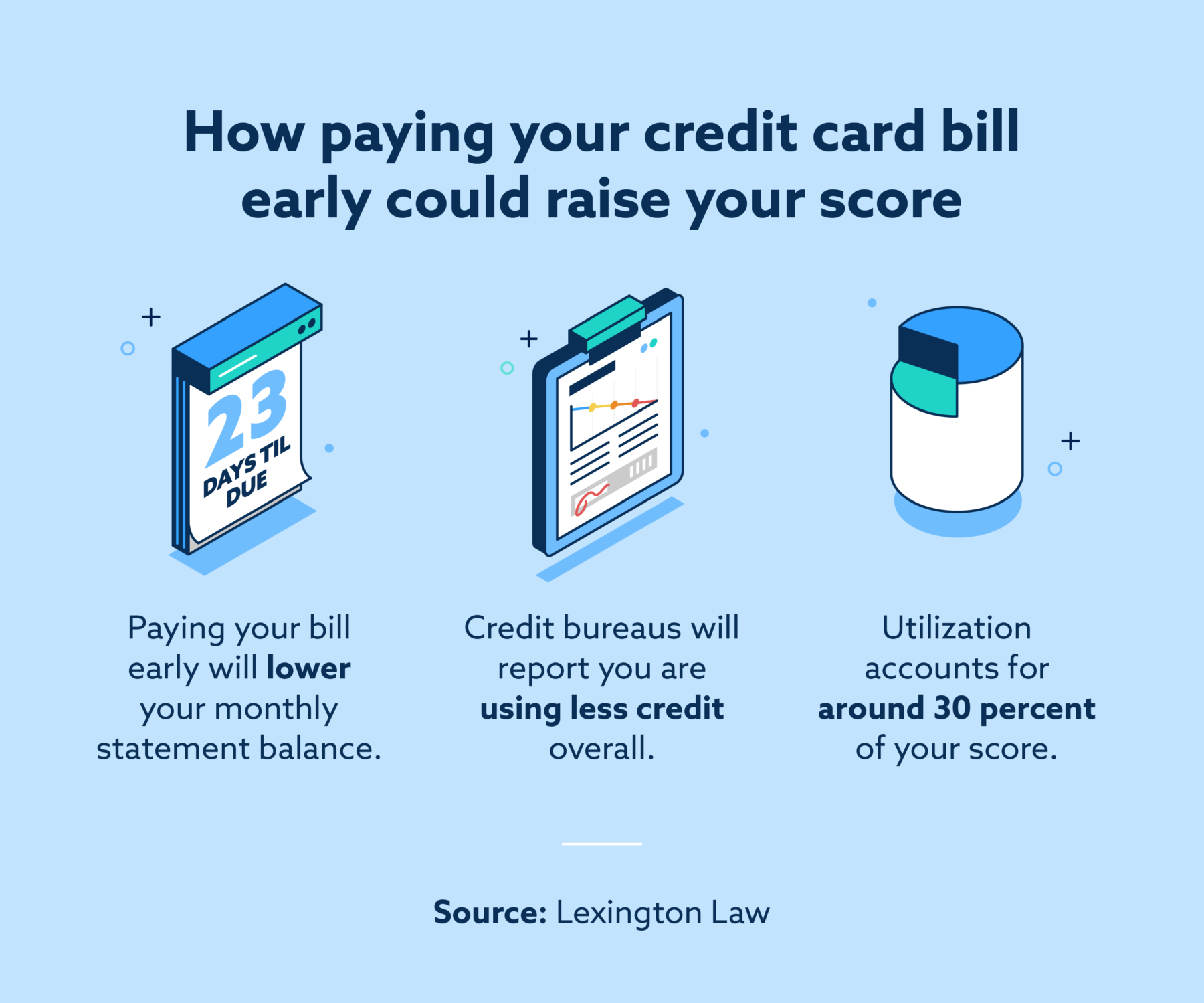

If you could find an extra $40 in your budget and you paid $80 each month, you would. To lower these fees, ask your credit card company to lower your rates. Save for 3 to 6 months of expenses.

Higher rewards — ask for more points or more flexible rewards. This is why it’s important to contact your credit card companies immediately if you know you can’t pay your bill. They might say no, but.

You can ask if they’ll allow you to apply points to pay off your balance faster. “if you have the average credit card balance ($5,270 according to transunion) and you only make minimum payments at the average. There are a few ways to negotiate your credit card debt, depending on your particular situation and your goals:

Ad one low monthly payment. The average credit card balance for americans is $5,221, according to bankrate. He also suggests changing your credit card due date to the last day.

A pair of bipartisan bills in congress aim to lower the swipe fees, also known as interchange fees, that retailers pay every time a customer makes a purchase with their card. Pad your existing savings account. A 0% balance transfer credit card may be your best weapon in the battle against credit.

/7-things-you-didnt-know-affect-your-credit-score.aspx-ADD-V2-f87cdc4ddf2c4c7a93d078f56015ed55.jpg)